box 7 distribution code g We would like to show you a description here but the site won’t allow us. Buy 2024 DREAMFIRE Kitchen 304 Stainless Steel Double-Layer Insulated .

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

The 2x4 frame wall has 2" rigid insulation behind it, but the box only has 1/2" plywood behind it. So the face plate of the box sits in a 1-1/2" recess. My wife wants to hang a picture over the panel box to cover this recess. Is there any hazard to putting objects in front of the breaker box?

Distribution code G is a direct (trustee to trustee) rollover. You do not pay any tax on it. The gross distribution will be included on Form 1040 line 15a or Form 1040A line 11a, but nothing will be added to line 15b or 11b, which is the taxable amount. June 7, 2019 2:58 PM.Distribution code G is a direct (trustee to trustee) rollover. You do not pay any tax .TurboTax is here to make the tax filing process as easy as possible. We're .Find TurboTax help articles, Community discussions with other TurboTax users, .

We would like to show you a description here but the site won’t allow us.

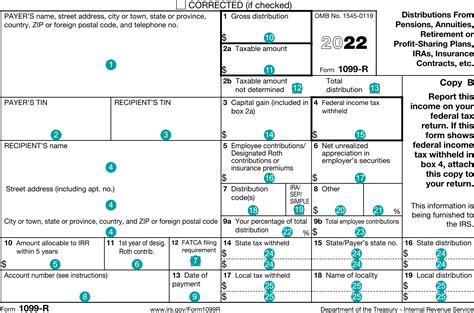

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a . Code G in box 7 of a 1099-R is a direct rollover to an IRA. You need to enter the 1099-R and answer all the follow up questions to make sure your are not taxed on the rollover. .

A distribution to a domestic abuse victim is a distribution made from your applicable eligible retirement plan that is no greater than ,000 (indexed for inflation) and is made during the 1 .

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. Also use when non-Roth QRP .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

Distribution Code Table entries on Form 1099 on Box 7. amounts reported on Form 1099-R. Description of Codes in Box 7. Distribution code G is a direct (trustee to trustee) rollover. You do not pay any tax on it. The gross distribution will be included on Form 1040 line 15a or Form 1040A line 11a, but nothing will be added to line 15b or 11b, which is the taxable amount. June 7, 2019 2:58 PM.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible retirement plan (another qualified plan, a section 403 (b) plan, a governmental section 457 (b) plan, or an IRA). See Direct Rollovers in the IRS instructions for Form 1099-R for more information.

Code G in box 7 of a 1099-R is a direct rollover to an IRA. You need to enter the 1099-R and answer all the follow up questions to make sure your are not taxed on the rollover. Normally you would not receive a check with a direct rollover but the funds would be sent directly to the financial institution where the IRA is.

pension distribution codes

irs roth distribution codes

A distribution to a domestic abuse victim is a distribution made from your applicable eligible retirement plan that is no greater than ,000 (indexed for inflation) and is made during the 1-year period beginning on any date on which you are the victim of domestic abuse by a spouse or domestic partner. You may repay this distribution at any time

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. Also use when non-Roth QRP assets are directly rolled over to an IRA, and for in-plan Roth rollovers that are direct rollovers.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

irs pension distribution codes

ira normal distribution 7

Shop for Plastic Electrical Boxes in Electrical Boxes. Buy products such as Box Junction Outdoor Waterproof Electrical Electronic Project Abs Plastic Boxes Outdoors Enclosure Connection Diy .

box 7 distribution code g|box 7 1099 r