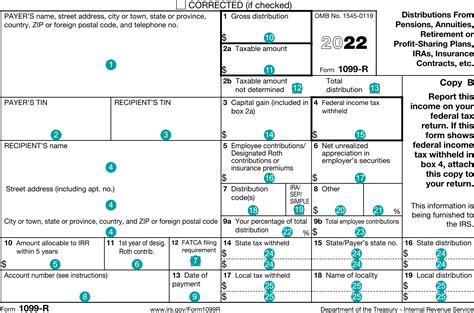

box 7 distribution code 1 Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years). Septic tank distribution boxes, also known as D-boxes, are a crucial component of any septic system installation. This comprehensive guide will explain what they are, how they work, why proper distribution is important, signs of a failing D-box, and steps for inspection, maintenance, and replacement.

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Discover the key differences between distribution boards and distribution boxes. Learn about their features, benefits, and applications in electrical systems. Make informed decisions for your power distribution needs.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

pension distribution codes

irs roth distribution codes

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early . Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified .

To report your loan that is treated as a deemed distribution into the program, please follow the pathway below and enter Code L plus Code 1 or Code B, (whichever is applicable) in box 7. .

The distribution codes used in Box 7 of Form 1099-R indicate the type of distribution that was made from the account. The codes range from 1 to 7 and include regular distributions, early distributions, and distributions from . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 1: Early .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo.

high precision pneumatic press sheet metal punching machine

irs pension distribution codes

high quality cnc lathe part

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no . Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .To report your loan that is treated as a deemed distribution into the program, please follow the pathway below and enter Code L plus Code 1 or Code B, (whichever is applicable) in box 7. Looking for more tax information and tips? SHOW ME MORE. The distribution codes used in Box 7 of Form 1099-R indicate the type of distribution that was made from the account. The codes range from 1 to 7 and include regular distributions, early distributions, and distributions from inherited accounts.

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 1: Early distribution, no known exception. This distribution is subject to the 10% penalty. 8 (Excess Contributions, Excess Deferrals, and Excess Aggregate Contributions taxable .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .

ira normal distribution 7

Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions. Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .To report your loan that is treated as a deemed distribution into the program, please follow the pathway below and enter Code L plus Code 1 or Code B, (whichever is applicable) in box 7. Looking for more tax information and tips? SHOW ME MORE.

The distribution codes used in Box 7 of Form 1099-R indicate the type of distribution that was made from the account. The codes range from 1 to 7 and include regular distributions, early distributions, and distributions from inherited accounts.

high quality cnc part supplier

Like the two-gang junction box, a three-gang box simply holds one more device than the double-gang unit. Still, this box type is less common because most devices are used by themselves or in even pairs.

box 7 distribution code 1|irs pension distribution codes