2016 gross distribution box 3 codes Check if Code 3 is in box 7 and the taxpayer is disabled and under the minimum retirement age* of the employer’s plan. This will reclassify the disability income as wages on Form 1040. Jake Sales 2-3/8" Wood Fence to Round Steel Post Panel Attachment Adapter .

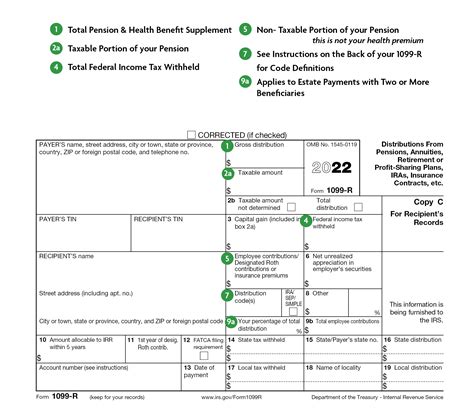

0 · What is HSA Form 1099

1 · Understanding Your 1099

2 · Reporting Form 1099

3 · Internal Revenue Service Department of the Treasury

4 · FORM 1099

5 · Don’t Run Rings Around IRS Form 1099

6 · 2016 Tax Guide

7 · 2016 Part III Partner’s Share of Current Year Income,

8 · 2016 Form 1099

9 · 1099

Organize and decorate with these floating wall shelves that would add style and function to your industrial-themed home space.

Box 3. If you received a lump-sum distribution from a qualified plan and were born before January 2, 1936 (or you are the beneficiary of someone born before January 2, 1936), you may be able .

This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040. For detailed reporting and filing .Check if Code 3 is in box 7 and the taxpayer is disabled and under the minimum retirement age* of the employer’s plan. This will reclassify the disability income as wages on Form 1040.

Box 1: Gross Distribution includes all payments for monthly Benefits, DROP, Leave, and Initial Benefit Option funds disbursed directly to you, contributions refunded upon leaving state service,

Death benefit lump sum (or 1959 survivor rollover) distribution made to a decedent's beneficiary or survivor, including their trust or estate. Indicates the amount reported is a death benefit lump sum distribution which may be .The 1099-R includes a form field where a code is used identify the type of distribution. This is indexed on Box 7. Code 1: Early distribution, no known exception; Code 2: Early distribution, exception applies; Code 3: Disability; . Box 1: Gross Distribution. Box 1 is titled “Gross Distribution.” Here, you’ll find the total amount that each retirement plan or program paid to you during the tax year. You may .

WHAT IT SHOWS: All gross distribution amounts from your fund and the amount of federal and/or state income tax withheld, if any. Depending upon the account type and nature of the .Box 1, the gross distribution; Box 3, one of the following codes (see Box 3. Distribution Code, later): 1—if the beneficiary is the spouse, 4—if the beneficiary is the estate, or 6—if the beneficiary is not the spouse or estate; Box 4, the FMV of the account on the date of death, reduced by any payments from the HSA made for the decedent .Box 3. If you received a lump-sum distribution from a qualified plan and were born before January 2, 1936 (or you are the beneficiary of someone born before January 2, 1936), you may be able to elect to treat this amount as a capital gain on Form 4972 (not on Schedule D (Form 1040)). See the Form 4972 instructions. For a charitable gift

This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040. For detailed reporting and filing information, see the separate Partner’s Instructions for Schedule K-1 . Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair market value of .Check if Code 3 is in box 7 and the taxpayer is disabled and under the minimum retirement age* of the employer’s plan. This will reclassify the disability income as wages on Form 1040.Box 1: Gross Distribution includes all payments for monthly Benefits, DROP, Leave, and Initial Benefit Option funds disbursed directly to you, contributions refunded upon leaving state service,

Death benefit lump sum (or 1959 survivor rollover) distribution made to a decedent's beneficiary or survivor, including their trust or estate. Indicates the amount reported is a death benefit lump sum distribution which may be eligible for the 10-year tax option method of computing the tax.The 1099-R includes a form field where a code is used identify the type of distribution. This is indexed on Box 7. Code 1: Early distribution, no known exception; Code 2: Early distribution, exception applies; Code 3: Disability; Code 4: Death; Code 7: Normal distribution; Code 8: Corrective refunds taxable in current year

What is HSA Form 1099

Box 1: Gross Distribution. Box 1 is titled “Gross Distribution.” Here, you’ll find the total amount that each retirement plan or program paid to you during the tax year. You may have received this amount in a number of different ways, including: A direct rollover; A transfer or conversion to a Roth IRA; A recharacterized Roth RIA contributionWHAT IT SHOWS: All gross distribution amounts from your fund and the amount of federal and/or state income tax withheld, if any. Depending upon the account type and nature of the distribution, the form may also report the taxable amount of the distribution.Box 1, the gross distribution; Box 3, one of the following codes (see Box 3. Distribution Code, later): 1—if the beneficiary is the spouse, 4—if the beneficiary is the estate, or 6—if the beneficiary is not the spouse or estate; Box 4, the FMV of the account on the date of death, reduced by any payments from the HSA made for the decedent .Box 3. If you received a lump-sum distribution from a qualified plan and were born before January 2, 1936 (or you are the beneficiary of someone born before January 2, 1936), you may be able to elect to treat this amount as a capital gain on Form 4972 (not on Schedule D (Form 1040)). See the Form 4972 instructions. For a charitable gift

metal detecting old house sites

This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040. For detailed reporting and filing information, see the separate Partner’s Instructions for Schedule K-1 . Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair market value of .

Check if Code 3 is in box 7 and the taxpayer is disabled and under the minimum retirement age* of the employer’s plan. This will reclassify the disability income as wages on Form 1040.

metal display box

Understanding Your 1099

Box 1: Gross Distribution includes all payments for monthly Benefits, DROP, Leave, and Initial Benefit Option funds disbursed directly to you, contributions refunded upon leaving state service,Death benefit lump sum (or 1959 survivor rollover) distribution made to a decedent's beneficiary or survivor, including their trust or estate. Indicates the amount reported is a death benefit lump sum distribution which may be eligible for the 10-year tax option method of computing the tax.The 1099-R includes a form field where a code is used identify the type of distribution. This is indexed on Box 7. Code 1: Early distribution, no known exception; Code 2: Early distribution, exception applies; Code 3: Disability; Code 4: Death; Code 7: Normal distribution; Code 8: Corrective refunds taxable in current year

Box 1: Gross Distribution. Box 1 is titled “Gross Distribution.” Here, you’ll find the total amount that each retirement plan or program paid to you during the tax year. You may have received this amount in a number of different ways, including: A direct rollover; A transfer or conversion to a Roth IRA; A recharacterized Roth RIA contribution

Reporting Form 1099

Unleash your creativity with the X-Carve Pro 4x4 CNC machine system—precision engineering for limitless possibilities. Experience unparalleled carving, cutting, and shaping capabilities in woodworking and more. Elevate your craft with this advanced CNC system. Configure, Design and Cut projects in minutes - all on one, easy-to-use platform.

2016 gross distribution box 3 codes|2016 Tax Guide